How Much Does Electric Car Insurance Cost on Average? (UK; 2024)

Find out why EV insurance is more expensive than an ICE equivalent here.

According to research by NimbleFins, the average cost of electric vehicle car insurance is around £654, for the most popular electric car models in the UK.

The range tends to be from around £400 to £1000, but prices fluctuate largely, depending on several factors.

On average, an electric car is more expensive to insure than a petrol or diesel model - usually because a brand-new EV is equipped with expensive, complicated technology.

Of course, car insurance isn’t a straightforward figure and will depend on a wide variety of factors.

Average Annual Premiums for Popular Electric Cars 2024

According to NimbleFins, these are the average of the five cheapest quotes found for each car. The premiums are based on a 35-year-old driver with five years no-claims bonus, living in Southeast England.

Data correct as of August 2024.

Tesla Model 3:£903

Audi e-Tron:£858

Hyundai Kona:£460

Kia Niro:£440

Nissan Leaf:£428

Volkswagen ID.3:£424

MINI Electric:£403

Which EV Models are the Cheapest to Insure?

According to research conducted by Compare The Market, the cheapest EV model to insure is the Renault Zoe Iconic R110. In second place was the Skoda Enyaq iV 60 Nav ecoSuite, and in third was the Hyundai Kona EV Premium 39kWh.

These prices are based on all the quotes supplied to customers over the course of three months. Of course, prices will differ when you put in your details – every quote will be personalised to your circumstances.

Is EV Insurance More Expensive than Regular ICE Insurance?

Electric car insurance is more expensive than insuring an ICE (Internal Combustion Vehicle). According to NimbleFins, costs can be as much as 13% higher than an equivalent hybrid or petrol car. There are several reasons for this:

-

Repair costs and parts availability. Since EVs are newer, they are more expensive to repair, and the parts harder to get hold of. Software is also more technical to repair.

-

Specialised mechanics. Not every mechanic can work on EVs; a specific qualification is needed. This may incur a higher repair cost.

-

Value of the vehicle. Electric cars tend to cost more than their ICE equivalents, so will cost more to insure.

-

Power and performance. Electric vehicles can accelerate quickly, and insurers may see this as a posing a potential risk.

-

Cover for the battery and cables.

-

Lack of historical claims data to base premiums on.

It is thought that insurance premiums will reduce with time, as technology advances, more technicians qualify, and the data builds.

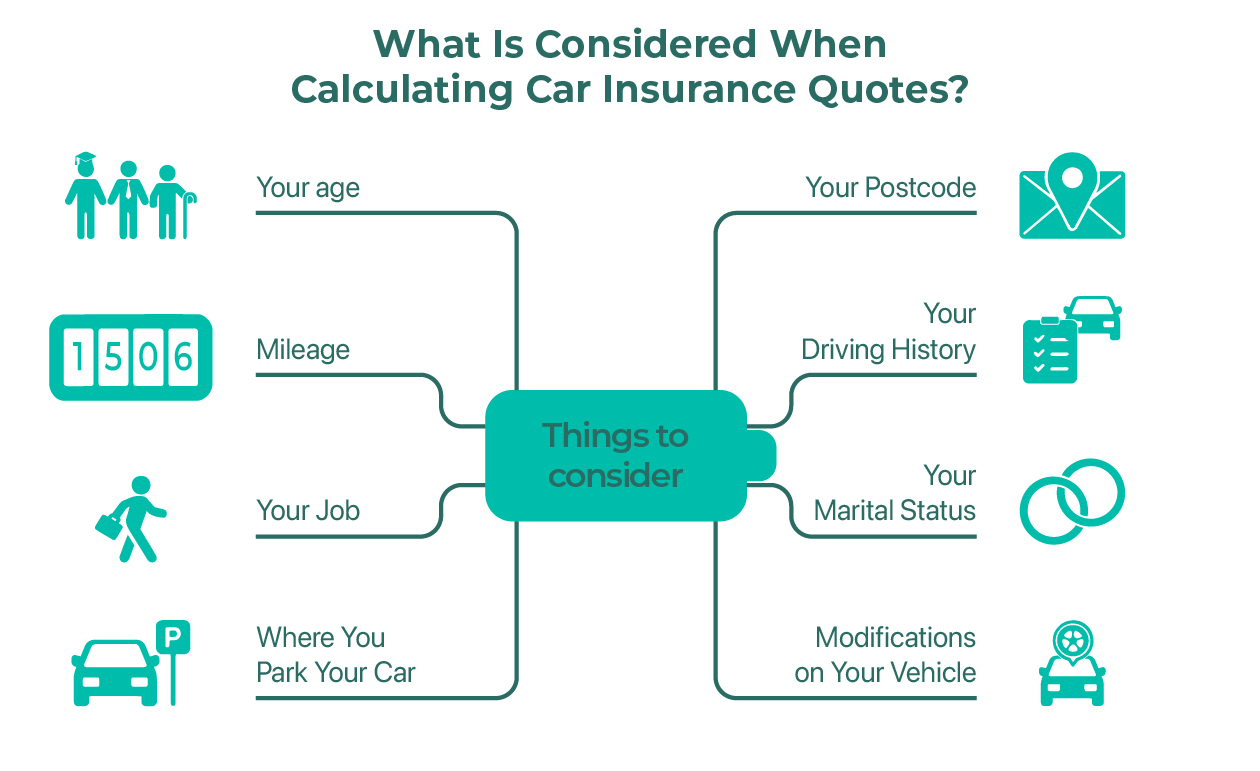

What is Considered When Calculating Car Insurance Quotes?

There are several things that are considered to work out your car insurance. These factors are considered when you buy insurance for either an electric car or an ICE car.

Your Age

Young and new drivers are often charged more as they are more likely to be involved in accidents. The same applies to drivers over the age of 75, as they are considered higher-risk drivers.

Mileage

If you drive your EV a significant number of miles each year, insurers perceive your risk of an accident to be higher than someone who drives less often.

Your Job

If you work in a ‘high-stress industry’ you may be subject to higher insurance costs due to lack of concentration on the road. If your job involves driving, you will need to pay more for insurance.

Where You Park Your Car

If you have a private driveway or garage, the cost of your insurance may go down as you are less likely to be hit by another driver whilst parked than a driver who has to park their car on a public street.

Your Postcode

If you live in a busy city where there are more vehicles, you will have to pay more, as there is more chance you may sustain vehicle damage than someone who lives in a quiet countryside. Areas with higher crime rates or risks of flooding may also be more expensive to cover things such as vandalism or flood damage.

Your Driving History

This affects your insurance costs hugely - if you have claimed on your previous insurance in the last 5 years you can expect to pay more. If you have speeding offences or points on your driving licence you are going to have to pay more, as the insurer may see you as a potential risk on the road.

Your Marital Status

This might sound like an odd one, but if a married couple shares an electric car, it spreads the risk of an accident in one vehicle over two people, therefore causing the insurance to go up.

Modifications on Your Vehicle

This could influence it either way - expensive sound systems may hike the price up, whereas immobilisers or fitted rear parking sensors may bring the price down.

Where Can I Compare Electric Car Insurance?

You’ll want to shop around for your electric car insurance so you can be sure that you are getting the best price. There are several sites you can use to do this:

To get a quote, you will need to provide the make, model, and year the car you are insuring. If you are yet to purchase your EV, you can take the details for the car from the manufacturer’s website.

You’ll also need your details such as name, age, address, any driving convictions, as well as what you’ll use the car for and your claims history.

Which Insurers Offer the Best Deals for Electric Car Insurance?

Most of the big insurance companies will offer electric car insurance, so if you are happy with your current insurer, have a look to see if they offer a premium that suits your EV.

According to research by Which?, the best car insurance policy for electric cars is Allianz car insurance as of January 2025, based on ten areas of electric car and equipment covers, including batteries, charging cables, and more. LV car insurance WRP and Axa Car Plus were also highlighted as good choices for electric car insurance policies.

Read More

Why are Electric Cars So Expensive?

Buying a new car comes with the expectation of a high cost. But electric vehicles, the newest trend taking the automotive industry by storm, seem to be even more expensive. What is it that makes electric vehicles so expensive? And will you save money in the long run? Find out in this article.

How Can I Afford an Electric Car?

As electric cars are still so expensive, many drivers are worried about how they can afford to own an EV. In this article, we discuss what finance options are available, the Government grants and other ways to own an electric car.

What is an Electric Car Subscription?

Looking for a convenient alternative to leasing? In this article, we cover what an electric car subscription is and what the benefits are.